When shipping goods across borders, one of the most common sources of confusion comes down to three simple questions:

Who arranges the transport? Who carries the risk? Who pays the costs?

That’s exactly what Incoterms (International Commercial Terms) were created to clarify. Published by the International Chamber of Commerce (ICC), Incoterms are a globally recognized set of rules that define the responsibilities of buyers and sellers in international trade.

Why Incoterms Matter

Choosing the wrong Incoterm can lead to disputes, unexpected costs, or delayed deliveries. For importers and exporters alike, understanding these rules provides clarity and helps avoid surprises. With the right Incoterm in place, both sides know their obligations from the moment goods leave the seller’s door until they arrive at their final destination.

The Basics: What Incoterms Define

- Delivery point: The exact stage where responsibility for the goods transfers from seller to buyer.

- Transport obligations: Who arranges freight, insurance, and customs formalities.

- Risk and cost allocation: Who pays for which parts of the journey, and who carries the risk at each stage.

The 11 Incoterms Explained

For Any Mode of Transport

- EXW (Ex Works): The seller makes the goods available at their premises. From that point, the buyer takes on all costs, transport, export clearance, and risks. The buyer must handle export customs in the seller’s country.

- FCA (Free Carrier): The seller delivers the goods to the buyer’s chosen carrier at an agreed place. The seller is responsible for export clearance. Risk passes to the buyer once the goods are handed to the carrier.

- CPT (Carriage Paid To): The seller pays for transport to the agreed destination, but risk transfers to the buyer as soon as the goods are handed over to the first carrier.

- CIP (Carriage and Insurance Paid To): Similar to CPT, except the seller must also purchase insurance. Under Incoterms 2020, CIP requires a higher “all risks” insurance (Institute Cargo Clauses A). Risk still transfers at the first carrier, not at destination.

- DAP (Delivered at Place): The seller delivers the goods to the named place of destination, ready for unloading. The seller bears all risks and costs up to that point. The buyer is responsible for unloading and for import clearance, duties, and taxes.

- DPU (Delivered at Place Unloaded): The seller delivers the goods at destination and unloads them. This is the only Incoterm that requires the seller to handle unloading. As with DAP, the buyer handles import clearance, duties, and taxes at the destination.

- DDP (Delivered Duty Paid): The seller takes on the maximum responsibility, delivering the goods ready for unloading at the destination, and handling both export and import clearance, including all duties and taxes.

For Sea & Inland Waterway Transport

- FAS (Free Alongside Ship): The seller delivers the goods alongside the vessel at the port of shipment and clears them for export. The buyer covers loading, freight, and everything beyond.

- FOB (Free on Board): The seller loads the goods onto the vessel at the port of shipment and clears them for export. Risk transfers once the goods are on board. The buyer pays the freight, insurance, and import costs.

- CFR (Cost and Freight): The seller pays for freight to the destination port, but risk transfers to the buyer once the goods are loaded on board at the origin port.

- CIF (Cost, Insurance and Freight): Like CFR, except the seller must also provide minimum cargo insurance (Institute Cargo Clauses C), unless higher coverage is agreed.

Choosing the Right Incoterm

The right choice depends on:

- Your desire, or lack thereof, for control over logistics providers.

- Your comfort with handling customs and duties at the destination.

- The level of risk you’re willing to take with your buyer.

For example, a seller looking for minimal responsibility may use EXW, while a buyer who prefers simplicity may request DDP so the seller manages everything, including duties. A negotiation between the buyer and seller often lands on an incoterm somewhere in the middle of these incoterms.

Final Thoughts

Incoterms simplify global trade when they’re clearly understood and correctly applied. At Journey, we can help our customers select the right terms so they can focus on serving their own customers. We can help take out the complexity of incoterms.

Download Your Incoterms Visual Guide

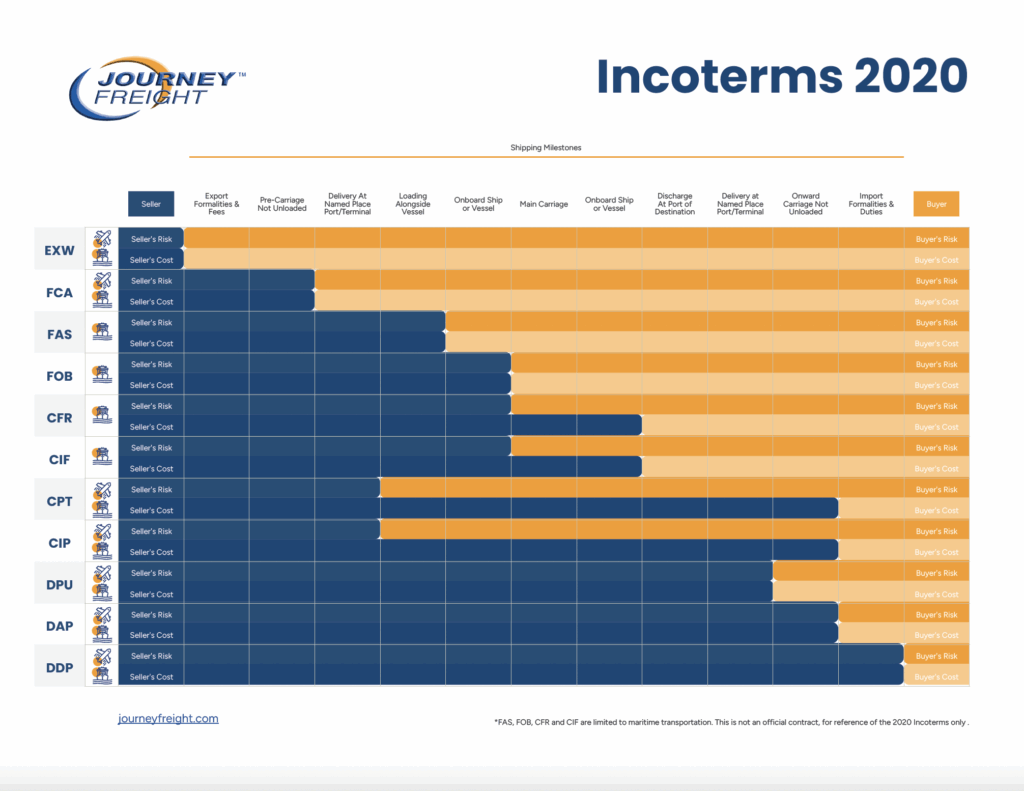

We’ve created a visual reference guide to make Incoterms easier to understand at a glance. This PDF is designed as a quick resource you can share with your team or keep on hand when negotiating shipping terms.

Frequently Asked Questions About Incoterms

What are Incoterms 2020?

Incoterms 2020 are the latest version of the International Commercial Terms, published by the ICC. They standardize how buyers and sellers divide costs, risks, and responsibilities in global trade contracts.

Do Incoterms cover insurance?

Only two terms include insurance obligations: CIF (minimum coverage, Institute Cargo Clauses C) and CIP (all-risks coverage, Institute Cargo Clauses A). For all other Incoterms, insurance is optional unless separately agreed.

Do Incoterms apply to domestic shipments?

Yes, while they are most common in international trade, Incoterms can also be used in domestic contracts when parties want a clear division of responsibilities.

Do Incoterms cover the transfer of ownership of goods?

No. Incoterms only govern cost, risk, and delivery responsibilities. Ownership and payment terms must be addressed separately in the sales contract.

What’s the difference between DAP, DPU, and DDP?

- DAP: Seller delivers to buyer’s door. Buyer clears customs and is responsible for any duty or taxes.

- DPU: Seller delivers and unloads at the port of destination. Buyer clears customs, and delivers to their own door.

- DDP: Seller delivers buyer’s door Seller pays for import duties and handles customs.